This article provides information about the dairy industry in Australia. We are not affiliated with Dairy Australia, the national services body for the dairy industry. The content on this page is for informational purposes only and may contain outdated information. For the most current and relevant details, please visit the official Dairy Australia website at https://www.dairyaustralia.com.au.

Dairy Australia primarily does a lot of research and development (R&D) to help Australian dairy farmers improve animal health, productivity and profits. It also undertakes collective investments on behalf of the industry, invests in research, develops extension training and provides industry services that individual farmers and dairy companies are unable to do themselves.

I will tell you everything you need to know about Dairy Australia and how you can benefit from it.

1. De-regulation and the formation of Dairy Australia

Dairy in Australia was once a highly regulated and subsidized industry. All this changed on the 1st of July, 2000 when the industry became completely deregulated and the federal government implemented the Dairy Structural Adjustment Program (DSAP). This brought about two major changes.

One, prices of milk produced by Australian farmers was no longer determined by government or the industry. Instead, it was determined by the world market. And two, the Australian dairy farmers now had to produce milk at lower costs in order to compete with other milk producers across the world.

Following the deregulation of all dairy marketing arrangements, the dairy industry in Australia needed a central body to take on the roles of different industry bodies including the Australian Dairy Corporation (ADC) and the Dairy Research, Development Corporation (DRDC) and several other regional as well as national bodies.

Within a few years, along with the support of the Australian government, Dairy Australia was setup as the country’s central body for dairy in June, 2003. Dairy Australia was setup as industry owned and funded unlisted public company that is accountable to its board, members and the government.

Today, Dairy Australia invested about $ 58 million across 13 strategic programs and has engaged about two thirds of Australian dairy farmers through some form of regional activity, events or online tools.

Dairy Australia (DA) primarily does three things. One, DA develops tools for farmers and the industry to assist in making decisions. Two, DA delivers services that support on-farm profitability. And finally, DA invests in research and innovation to support industry sustainability.

DA calls these three areas as their strategic priorities. To invest in their strategic priorities, Diary Australia needs to secure funding, maintain corporate governance standards and manage member rights.

Let’s see how they do this.

2. Funding, Corporate Governance & Member Rights

Funding

Depending on how much milk they produce, all dairy farmers in Australia pay a tax called the Dairy Services Levy.

Dairy Australia has a Statutory Funding Agreement (SFA) with the Department of Agriculture and Water Resources. According to this agreement the Commonwealth has agreed to pay the dairy service levy funds that it collects from its dairy farmers to Dairy Australia.

In addition to this, the government will also match an equal payment contribution.

Corporate Governance:

In return for getting this funding, DA is mandated to:

- Meet the necessary corporate governance and board requirements

- Meet requirements for a performance review against the agreement

- Manage and use the funds in accordance with Commonwealth guidelines

- Consult with levy payers, members and the Commonwealth where needed

- And report strategic plan, annual operational plan, evaluation frameworks, compliance audits etc.

Also by law, Dairy Australia as an unlisted public company that is accountable to its members, levy payers, the government and other industry stakeholders.

It is also bound to operate within a corporate governance framework that consists of:

- Australian Charities and Not-For-Profits Commission Act 2012 (Cth)

- Objects (purpose) of the company

- Statutory Funding Agreement with the Commonwealth of Australia

- Consultation processes with members

- Other relevant laws such as the Corporations Act 2001 (Cth)

Membership Rights

By law, DA has two classes of members:

Group A members: Consisting of dairy farmers who pay the dairy services levy and then get elected to become members. These members have voting rights on resolutions and director appointments.

Group B members: Consisting of bodies that represent the Australian dairy industry. This currently consists of the Australian Dairy Farmers and Australian Dairy Products Federation. These members do not have voting rights but can move resolutions at general meetings.

Next, let’s learn more about Diary Australia’s leadership team that is responsible for getting results.

3. Dairy Australia’s Leadership Team

Dr. David Nation, leads Dairy Australia as its Managing Director. He has a career in dairy that spans over 20 years, including leading roles in a number of key dairy innovation projects. Before joining Dairy Australia in 2018, David was Co-Director of DairyBio and DairyFeedbase, and Chief Executive Officer of the Dairy Futures Cooperative Research Centre.

Charlie McElhone, leads the Trade and Industry Strategy team at Dairy Australia. He and his team are responsible for facilitating profitable international trade of Australian dairy products. Charlie has a long history of improving policy and advocacy of the food sector. Before he joined DA, Charlie was the General Manager of Policy at the National Farmers Federation (NFF).

Peter Johnson, leads the Farm Profit and Capability Group. Along with his team, he invests in DA’s research, development, extension and education activities to improve profits of the Australian dairy farmers. He previously led DA’s Feedbase & Nutrition portfolio. He has a broad range of Agribusiness experience working in organizations such as Pasture Seed Industry, Rabobank and NSW Agriculture.

Elizabeth Parkin, leads the Business and Organisation Performance Group which includes Strategy and Corporate Planning. Before joining DA, Elizabeth has over 25 years of experience in senior management and corporate advisory roles in leading firms such as KPMG and Lander & Rogers.

Kendra Campbell, leads all DA’s consumer marketing, communications and digital efforts. Kendra has over 15 years of experience in marketing, corporate communications and public relations (PR). Before joining DA, she was the Marketing Manager at Coles Express. At DA, Kendra’s portfolios span across brand advertising, marketing, product development, PR, media relations, stakeholder communications and engagement, issues and crisis management, and internal/external communications.

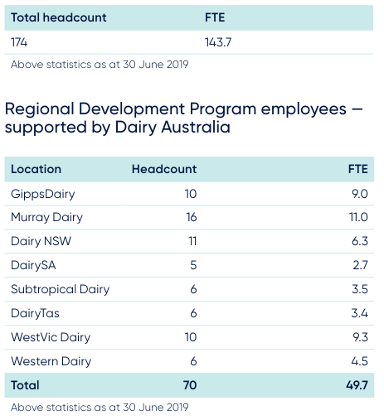

In addition to this leadership team, DA has a total staff of 174 people. Of them, 70 are located across the Rural Development Programs (RDPs) in Australia’s 8 dairy regions. Through them, DA works closely with the RDPs to support farmers and players in the dairy supply chain.

Next, let’s see how DA works with the 8 dairy regions and some key stats from each of these regions.

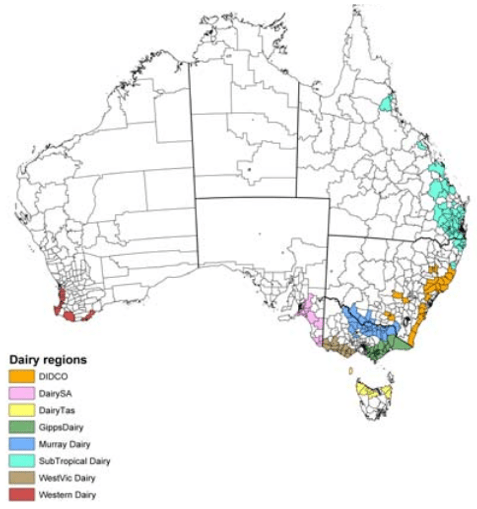

4. Working with the 8 Dairy Regions of Australia

Australia has 5,700 dairy farms and each of them are located in one of its 8 dairy regions. Each dairy region has its own set of opportunities and challenges.

To address their specific requirements, regional development programs (RDPs) were setup in the 1990s. Today, DA works closely with these eight independent entities (RDPs) to serve the needs of their regions.

The eight dairy regions of Australia are:

- Gippsland

- Murray

- New South Wales

- South Australia

- Subtropical

- Tasmania

- Western Australia

- Western Victoria

And here are some quick dairy facts on each of these 8 dairy regions:

Gippsland

This region is home to 1,324 dairy farms and about 334,000 cows. Collectively this region produces around 1.987 billion litres of milk, accounting for 21% of Australia’s total milk production.

Murray

This region is home to 1,372 dairy farms and about 350,000 cows. Collectively this region produces around 2.074 billion litres of milk, accounting for 22% of Australia’s total milk production.

New South Wales

This region is home to 411 dairy farms and about 114,000 cows. Collectively this region produces around 0.817 billion litres of milk, accounting for 9% of Australia’s total milk production.

South Australia

This region is home to 228 dairy farms and about 75,000 cows. Collectively this region produces around 0.505 billion litres of milk, accounting for 5% of Australia’s total milk production.

Subtropical

This region is home to 519 dairy farms and about 100,000 cows. Collectively this region produces around 0.542 billion litres of milk, accounting for 6% of Australia’s total milk production.

Tasmania

This region is home to 412 dairy farms and about 175,000 cows. Collectively this region produces around 0.913 billion litres of milk, accounting for 10% of Australia’s total milk production.

Western Australia

This region is home to 159 dairy farms and about 66,000 cows. Collectively this region produces around 0.385 billion litres of milk, accounting for 4% of Australia’s total milk production.

Western Victoria

This region is home to 1,274 dairy farms and about 347,000 cows. Collectively this region produces around 2.066 billion litres of milk, accounting for 22% of Australia’s total milk production.

To support these 8 dairy regions effectively, DA needs to raise funds and invest in programs. Let’s understand how DA does this in more detail.

5. Dairy Australia’s Revenues & Investments

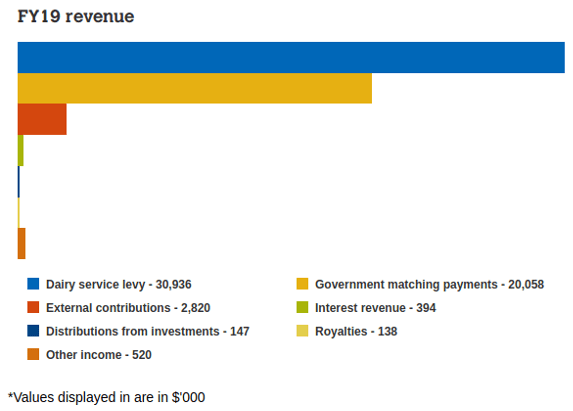

As discussed earlier, DA’s primary revenue sources are dairy service levy and Government funding.

In FY19, the government deducted 2.8683 cents per kg of milk fat and 6.9914 cents per kg of protein produced by Australian farmers. This amounted to 30,936,000 dollars and made up 56% of DA’s funding.

In addition to this, DA also received commonwealth government funding worth 20,058,000 dollars. This contributed to 36% of DA’s total revenues. The remaining 8% of revenues came from interest, distributions and other sources.

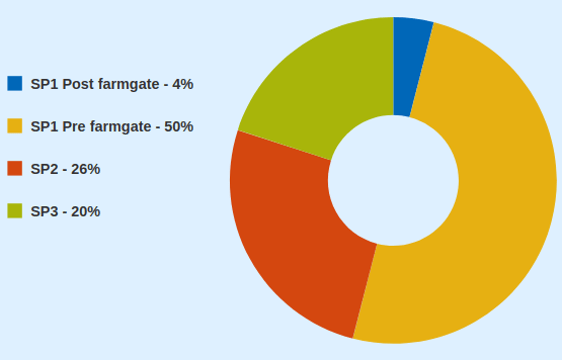

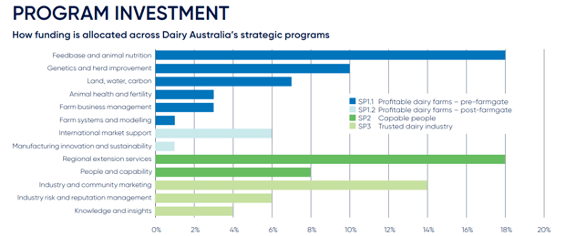

In the same year, DA also invested 58,789,000 dollars across several projects, programs and services that fall under three strategic priorities (SP). Their fund allocation breakdown is shown in the below picture.

1. Strategic Priority 1 (SP1) Profitable Dairy Farms

DA allocated 54% of its funding towards SP1. This includes both pre and post farmgate activities aimed at improving productivity as well as industry sustainability.

2. Strategic Priority 2 (SP2) Capable People

DA allocated 26% of its funding towards SP2, focusing on education and training to enhance the capability of farmers, extension workers, manufacturers and other industry participants.

3. Strategic Priority 3 (SP3) Trusted Dairy Industry

DA allocated 26% of its funding towards SP2, focusing on maintaining the industry’s long-term ‘social licence to operate’. This included branding, marketing and communication projects.

Ultimately, these investments need to result in improving farmer profits, industry standards, capacity of people and the brand of the Australian dairy industry. Let’s look at how DA’s investments in their three strategic priorities improve these outcomes.

6. Improving Farmer Profits

To help dairy farms become more profitable, DA has launched several programs to improve productivity and identify best practices. Some of them are:

health and fertility

DA works with farmers to enhance animal reproductive performance and milk quality. Through its website and various training programs DA also promotes animal husbandry best practices.

Genetics and herd improvement

DA has invested in organisations such as DataGene and DairyBio to help farmers become more productive and profitable.

DataGene brings together many herd improvement functions such as improved genetics, herd testing software, herd recording software and data systems. DairyBio is a joint venture between DA and the Victorian Government to deliver improved pasture and animal options for farmers.

Feedbase and animal nutrition

A program to improve farm profitability and resilience by optimising feeding systems and creating more efficient feedbase management practices.

Farm business management (FBM)

A combination of training programs and a set of business tools such as DairyBase, used to build better business management capacity in farmers and advisors.

Farm systems and modelling

A set of initiatives by DA that helps farmers integrate new technologies on their farms.

Land, water, carbon

Resources to help the dairy industry manage land, water and energy resources in a manner that minimises environmental impact and improves profit.

7. Improving Industry Standards

In addition to helping farmers become more profitable, DA also works with other players of the Australian dairy supply chain to reduce costs and improve market conditions. DA has two primary interventions, they are:

International market support

DA actively works with key international markets across the world to secure a more favourable export trading environment through trade policy reforms and buyer preference for Australian dairy products.

Manufacturing innovation and sustainability

DA also funds and supports key supply chain innovations that have the potential to significantly reduce costs and improve long term sustainability.

8. Equipping People of the Dairy Industry

DA invests in people through regional extensions services and quality educational programs. This also helps the industry attract better labour and talent. A few programs that DA has invested in are:

Regional extension services

To facilitate on-farm adoption of best farming practices, ideas, technology and research findings.

Large supplier engagement

To engage with large suppliers in each region, identify the major problems they face and co-develop solutions along with milk processors, banks and other industry partners.

Operations & Delivery

To improve the delivery of effective and quality extension services and programs that meet regional and industry priorities.

Tactics for Tight Times

To assist dairy farmers in southern Australia to confidently manage the current market and seasonal conditions and to enhance their ability to confront future challenges.

People & Capability

To improve the attractiveness of dairy as a career option by improving on-farm human resource management and facilitating a safety-first culture on-farm.

9. Branding, Promoting & Marketing the Australian Dairy Industry

And finally, to help Australian dairy maintain its brand advantage, DA also invests in several industry promotions and marketing campaigns. Some of them include:

Consumer Marketing & Communications Program

To improve the consumer’s trust in the Australian dairy industry and its products. And increase the perceived value of Australian dairy products.

DA also delivers campaigns that celebrate the Australian dairy industry by reinforcing its numerous health, nutrition, community and economic benefits.

Primary Schools Program

To provide a curriculum-linked program that enables teachers to educate students about the health benefits of dairy foods benefits, the farm to plate process and career opportunities in the dairy industry.

Healthcare Engagement Program

To provide evidence-based tools and resources to help healthcare professionals address patient concerns and recommend dairy.

Celebrity Influencer & Ambassadors

DA works with celebrity influencers and ambassadors who are widely recognised and ideally have a connection to the dairy industry to promote the Australian dairy farmers and industry. This program has helped DA work with celebrities such as chef Matt Moran and lifestyle influencer Emma Hawkins.

10. Key Achievements in 2019

In addition to the above programs, based on anecdotes from their 2019 Annual report, some of their other successful interventions include:

- Engaging and inspiring more than 2,500 young people through the Young Dairy Network.

- Achieved yield increases of 20% through DairyBio Hybrid Perennial Ryegrass trials.

- Completed year 1 investment in Dairy FeedBase to achieve rapid development in measuring pasture quality and quantity.

- Achieved 99% compliance to an industry target for completely phasing out calving induction by 2022.

- Registered additional dairy farmers and advisors on the farm business performance tool DairyBase, taking the total number of users to 2,470 farms.

- Continued collaborative investments with other Research and Development Corporations and research

- partners to address shared challenges and leverage research findings.

- Contributed to the development of other industries sustainability frameworks, both nationally and internationally.

- Published Dairy Farm Monitor results for 230 farms across all 8 regions, providing strong analysis and insights into farm performance across different regions and herd sizes.

- Delivered the DairyPath program enabling young people to tailor their learning pathway and maximise their potential in the dairy industry.

- Delivered significant project with DataGene implementing a new and improved computing infrastructure for genetic evaluation.

- Invested $5 million into Regional Development Programs to provide local, relevant and accessible services to dairy farming communities.

- Identified and responded to four emerging material sustainability risks — sustainable dietary nutrition, antimicrobial stewardship, food waste and human rights.

- Delivered Cows Create Careers to 259 schools, reaching over 14,000, and involving 535 volunteer farmers and industry advocates.

- Delivered flagship market analysis report Situation and Outlook, reaching over 8,000 direct recipients, 1,000 website views and 13,400 social media users.

- Enhanced promotion of dairy across key Asian markets through a joint commodity market development program with Meat & Livestock Australia, Horticulture Innovation Australia, Wine Australia and Austrade.

- Played a critical role in supporting the development of the Australian Dairy Plan, recognising the need for the industry to deeply engage and set out priorities for the next five years.

- Launched a new consumer marketing program Dairy Matters, to build trust in dairy through transparent information on product and practices. 78% of the socially conscious target audience ‘feel more supportive of the dairy industry’ as a result of the campaign.

- Redeveloped the Discover Dairy online resource hub to increase accessibility, usability and drive increased dairy education in primary school classrooms. Over 159,000 page views and 14,000 resource downloads in first six months.

- Delivered the redeveloped Picasso Cows schools education program to 130 primary schools, reducing costs by 78%.

- Secured funding from the Federal Government under the Smart Farming partnership to build a Natural Capital and Climate Risk reporting tool for dairy.

- Delivered over 1,000 farmer facing events, reaching 6,100 people – to increase knowledge, develop skills and connect with dairy communities.

- Enhanced relationships in key markets of Japan, China and South East Asia. 55 participants in scholarship programs and 860 attendees at in-market seminars.

- Piloted ‘Our Farm, Our Plan’ program that provides strategic planning and risk management support for farmers.

- Established the DairyLearn partnerships network to deliver vocational training through registered training organisations.

- Established a Learning and Development team to deliver training needs and technical information for people on-farm, in-factory and to support services, helping drive on-farm adoption.

- Played a critical role in all major policy discussions informing the decision-making process on key areas including Free Trade Agreements, Geographical Indicators, climate change, water, animal welfare and gene technology.

11. The Way Forward & Dairy Australia’s 2021-2025 Strategy

As most of you know, 2018-19 season was one of the toughest years that we have all faced.

Drought, lack of predictable rainfall and bushfires significantly affected the dairy industry. This resulted in increased input costs and reduced farm profits. In turn, our national milk production also decreased by 5.7 percent to a total production of 8.8 billion litres.

Amidst these realities, DA’s strategic plan spanning from 2016-17 to 2018-19 also came to an end. As we enter into the new decade, DA will now collaborate with key stakeholders to develop the next strategic plan. This new strategic plan will span from 2021 to 2025.

Over the next few months, to develop the next strategic plan, DA will collaborate with the following stakeholders

- Dairy Australia staff

- Dairy Australia Board

- Australian Dairy Farmers (ADF) and State Dairy Farming Organisations (SDFOs)

- Australian Dairy Products Federation (ADPF)

- Regional Development Programs (RDPs)

- Department of Agriculture, Water and the Environment (DAWE)

- Australian Dairy Plan (ADP) committee

DA is expected to come up with a finalized strategic plan by June 2020. This will set the direction for all stakeholders of the Australian dairy industry.

Perhaps you found this information useful and are looking at dairy farming in Australia. Australia offers a unique competitive advantage for dairy farming by fostering the perfect environment to grow pasture as a cheap and highly nutritious feed source. This is essentially the birthplace of Pasture.io.

12. Additional Reading

- Australian Dairy Conference 2019

- What are The Main Dairy Farming Problems in Australia?

- DairyTas Tasmanian Dairy Conference 2019

- DairySA Agtech Innovation Day 2019

- The Dairy Research Foundation's 2019 Symposium

- 2020 Fonterra Dairy Share Farmer Winner

- Why you should attend the Australian Dairy Conference (ADC2020)

- Fun facts about dairy cows & the dairy industry

- The welfare of dairy cows in Australia: A reality check by Dairy Australia

- Seaweed in cows diets could reduce 90% of their methane emissions

- What are the five dairy farm feeding systems in Australia?

- Dairy Australia’s 2024 Forage Value Index is Out. Here’s How It Can Help You Choose The Right Ryegrass Cultivar