Article Summary:

Needless to say, 2020 was an intensely challenging year for the dairy industry, thanks to the global pandemic. Dairy producers in Australia were forced to deal with a major disruption in supply chains and implementing new Covid-19 protocols. And they also had to deal with increasing input costs and growing global competition. But even in this backdrop, the future of Australian dairy continues to be bright. Let’s take a look back at the Australian dairy industry and talk about a few trends that are beginning to emerge.

Needless to say, 2020 was an intensely challenging year for the dairy industry, thanks to the global pandemic.

Dairy producers in Australia were forced to deal with a major disruption in supply chains and implementing new Covid-19 protocols.

And they also had to deal with increasing input costs and growing global competition. But even in this backdrop, the future of Australian dairy continues to be bright. Let’s take a look back at the Australian dairy industry and talk about a few trends that are beginning to emerge.

The ACCC and ADPF Initiatives:

Last year, two key initiatives were put in place to bring back stability to the industry. The first is the Dairy Code of Conduct, which is an industry code governed by the Australian Competition and Consumer Commission (ACCC). This code aims at improving transparency and trading arrangements between dairy farmers and processors.

The other initiative was the launch of the Australian Dairy Plan. This is a strategic plan that lists out a set of initiatives aimed at creating a profitable, confident and united Australian dairy industry within a timeline of five years and beyond.

Last November, the Australian Dairy Products Federation, or ADPF, launched something called the Milk Value Portal or MVP.

MVP plans to provide clarity and transparency on farmgate milk pricing and provide information publicly on www.milkvalue.com.au.

The Farmgate Milk Value Tool uses aggregated primary data to show the averages and range values of raw milk in each region. It also takes into account farm size, time of year and milk composition like fat and protein. Apart from these, the portal provides relevant insight on markets, supply chains and their influence on price to provide the right picture of just what the value of raw milk is.

The hope with MVP is that farmers will be better equipped with the right information to make solid business decisions, increase confidence in the industry and optimise both supply and production.

According to forecast reports, the farmgate milk price will flatten out towards 2030 at an average of around A50 cents per litre.

But let’s not think that far ahead! The milk price is forecast to increase by 2% to 48.8 cents per litre in 2021-22 and the import of dairy products is returning to how it used to be before the start of the Covid era.

It’s cheesy but it’s true:

Australian dairy industry is getting cheesy about…. You guessed it, cheese!

So what’s all the fuss about cheese?

The Health Star Ratings, guided by Australian Dietary Guidelines, identify five food groups that are essential for a balanced diet. The five food groups are – grains, vegetables, fruit, lean meats, poultry and dairy which includes milk, yogurt and cheese.

However, in November 2020, the Health Star Rating calculations were changed up a bit and more than half of all cheeses continued to score less than 3 out of 5 stars, putting it on par with junk food due to its sodium and fat content.

In 2021, the Australian Dairy Products Federation will work in tandem with Dairy Australia to give cheese a good name with the health brigade, promote the nutritional benefits of cheese and the importance it plays as part of a balanced diet.

It’s all about the money, honey

There is a continued increase in total capital investment in the dairy farming industry that looks like it will continue until 2030, but not as much as it was in 2017.

However, cash costs are on an upward trend which, if it goes on the same way, would result in farmers facing costs of over $A900,000 each year by 2030. Income would increase by 26% each year, which amounts to $A 1,080,000. This income growth shows the importance of continued growth, productivity and efficiency in the dairy sector.

Domestic milk production

Australian milk production is set to increase by 1% in 2020-21.

Milking cow numbers are forecast to rise at 2.7%

Average yield is expected to decline after 3 years of strong growth (due to forecast restocking which means retaining older cows and a higher proportion of young heifers as replacements wherein the heifers will yield less in their first few milking years.)

Wet conditions in 2020 lead to pastures flourishing with increased growth, lower grain and hay prices and increased feed reserves!

Live exports

In the past, during droughts in 2018 and 2019, dairy farmers were hit by bad weather and high feed prices and used live exports as a way to reduce herd numbers.

However, Australia’s dairy farmers today are analysing the pros and cons of how profitable it is to produce and export heifers against the profitability of increasing herd size to produce milk and great weather and seasonal conditions and goals to rebuild herds are slowly reducing live export numbers by 23% in 2020-21.

Water Prices

Water allocation prices will continue to be low for the rest of 2020-21 because of recharged storages and high rainfall. However, water prices are expected to rise over the projection period to 2025-26 due to high demand from horticultural farms and because of a hotter and drier outlook.

Smart Tech

And of course, when we’re talking about new trends, new paths, the new way forward, can technology be left behind?

Smart tech continues to be a strong pillar supporting the dairy industry and there is a huge influx of big data through sensors in the dairy industry.

Robotic cow milking: This multi-million dollar tech is one of the most well-known applications of robots in the dairy industry. These robots not only milk the cows but also washes, massages and feeds them! These robotic systems can milk multiple cows at the same time while maintaining a clean environment that keeps the cows healthy. The cows seem to enjoy it too as studies have shown that they go back on their own free will!

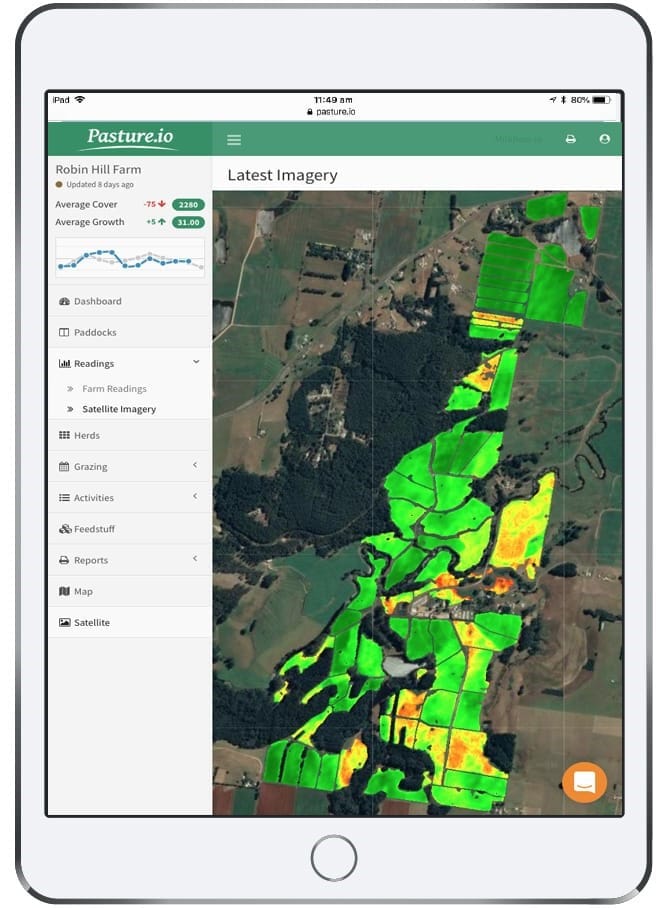

Drones and Satellites: Drones and satellites to aerially monitor farm lands to provide dairy farmers with near real-time information on pasture covers, growth rates and crop health.

If this is an area of interest for you, consider reading how satellites can help farmers measure pasture growth rates. With increasing labour costs, manual pasture measurements are becoming too costly for commercial livestock farms to implement.

This is where remote pasture measurement services can help farmers make effective pasture management decisions at a fraction of the cost.

But more importantly, by using our deision support tool, our customers earn more than $60,000 of additional annual profits, from increased yields and production.

The Way Forward

Coming back to our dairy industry trends overview, we all know that Australia enjoys the status and the responsibility of manufacturing the world’s best dairy products for both domestic and international markets.

And as we embrace the coming decade, Australia is not shying away from the upcoming challenges nor its past achievements. With resilient dairy farmers and new market opportunities in sight, we continue to stay positive about the future of the Australian dairy industry.

- The Dedicated Team of Pasture.io, 2021-06-15